Realtor.com’s Best Time to Buy Report just dropped, and it is worth paying attention to.

Their 2025 analysis highlights the week of October 12–18 as a national sweet spot for buyers, with potential savings of more than $15,000 on a median-priced home. Markets like Phoenix, Denver, and Orlando show clear seasonal advantages.

But the question for local buyers is always the same: What does this mean for the Triangle?

Our market operates on a different rhythm, shaped by job growth, relocation demand, and historically tight supply. And this fall, several conditions may quietly work in buyers’ favor, especially across Raleigh, Cary, Wake Forest, and surrounding areas.

1. National Trends at a Glance

According to Realtor.com, mid-October creates a rare alignment of conditions that benefit buyers:

- More inventory: listings up 32.6% compared to earlier in the year

- Less competition: buyer demand down 30.6% from peak season

- Lower prices: homes listed 3.4% below seasonal highs

More homes. Fewer buyers. Better prices. That combination does not appear every year, and when it does, the window is usually short.

Explore how experienced buyers evaluate timing, risk, and leverage in our Decision Intelligence series.

2. How the Triangle Stacks Up

The Triangle often reflects national patterns, but rarely in a straight line.

Zillow recently reported that new listings across the U.S. fell to record lows in August 2025. Locally, however, Raleigh continues to show resilience. Home values remain up year over year, and steady fall inventory has created more room for negotiation than many buyers expect.

This divergence is why national “best week” headlines should always be filtered through local data.

Review recent local trends inside our Triangle Market Intelligence updates.

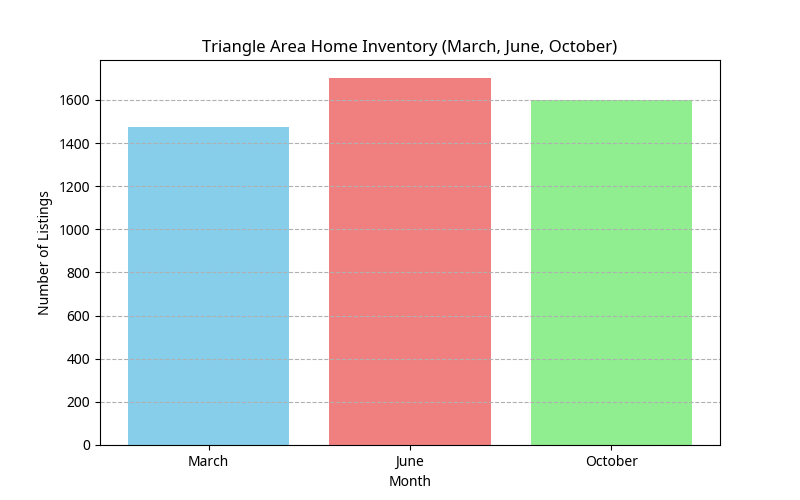

Inventory

While spring typically delivers the largest inventory surge, fall remains surprisingly healthy in the Triangle. Recent seasons show that listings tend to hold through October, offering buyers more choice than expected outside the spring rush.

October continues to bring steady options for buyers, not just the spring months.

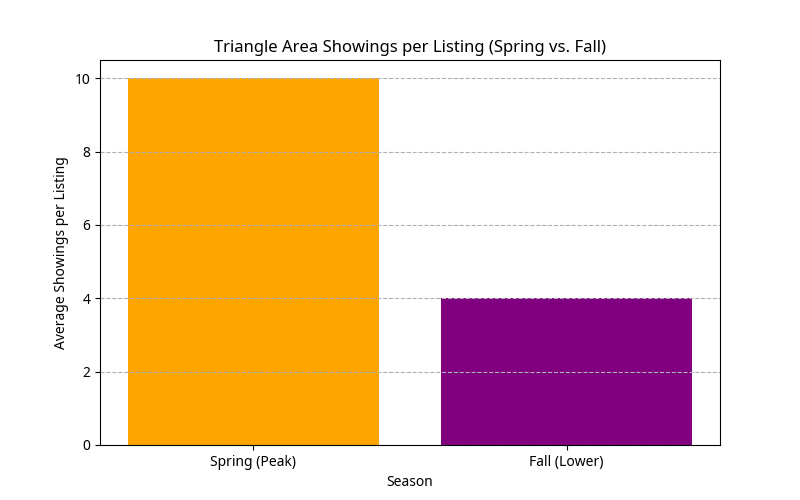

Competition

Showings per listing tend to peak in March and April, then gradually ease as the year progresses. By fall, buyer competition is typically lower than during the spring surge, creating more space to evaluate options, negotiate terms, and move without the pressure that defines peak season.

Recent fall markets have given buyers more negotiating power on price.

3. Rates Are Starting to Ease

Following the Federal Reserve’s September rate cut, the average 30-year mortgage rate dipped below 6.5% for the first time since early 2023, according to Forbes.

Lower rates are encouraging, but they do not guarantee stability. Local lending expert Jon Ortiz of Success Lending notes that short-term dips often reverse.

“Lower rates are always good news for buyers, but they do not always last. We have seen rates dip after a Fed cut before and then climb right back up. The smarter approach is not waiting for a perfect number, but acting when several factors align. Right now, buyers in the Triangle have more inventory, less competition, and slightly better rates. That combination can materially improve affordability.”

Jon has guided buyers through multiple rate cycles, helping them evaluate opportunity rather than trying to time the bottom.

Understanding how inventory, competition, and financing interact is often more important than any single rate movement.

4. What This Means for Buyers

For Triangle buyers, fall 2025 presents a combination that does not appear every year:

- More homes to choose from

- Less buyer competition

- Increased negotiating leverage

- Improved affordability as rates ease

This type of window tends to reward preparation rather than speed. Buyers who understand their options and constraints are often positioned to act decisively when the right opportunity appears.

Review buyer considerations and next steps in our Buyer Resources.

5. A Note for Sellers

Although this report focuses on buyers, sellers should not ignore these signals.

When rates ease and buyers regain confidence, showing activity typically increases. Listing during the fall can position a home in front of motivated buyers before inventory tightens again later in the cycle.

For sellers, timing and pricing discipline remain critical. Markets that favor buyers still reward well-prepared listings.

You can request a current valuation here.

6. Why Trusted Guidance Matters

National reports provide useful signals, but outcomes are determined locally.

The Marti Hampton Real Estate team works closely with experienced lending partners, including Jon Ortiz at Success Lending, to help buyers and sellers evaluate opportunity with clarity rather than guesswork.

The goal is not to chase perfect timing, but to recognize when conditions align with individual goals.

References

- Realtor.com — Best Time to Buy Report (2025)

- Forbes — What the Fed Rate Cut Means for Mortgage Rates

- Freddie Mac — Primary Mortgage Market Survey